Setting my firm up to Run Like Clockwork: A Series

Dec 13, 2020

This post was originally just an email sent out to my list in the Summer of 2020. But I wanted to do an update and bring everyone on the journey. This is the first of a series of posts.

Also, I need to be transparent and let you know that some links are affiliate links which means if you buy, I may receive a small commission from the sale. This does not cost you anything. I only recommend products I 100% believe in.

This year, I started taking a course by The Workflow Queen: Kickoff With Asana for Bookkeepers and Accountants and was inspired to pick back up the book by Mike Michalowicz, Run Like Clockwork to start really taking workflows seriously. I’ve since re-listened to the book about 3 times.

When I started my accounting firm, I thought I would just be doing a little bookkeeping on the side. Soon it turned into wanting to create a business advising other small businesses and companies, as I found it difficult not to give high level advice--I may as well be charging for it. So about a year in, I started really thinking of my side hustle as a business. But I still wasn’t thinking of it running itself, or viewing it as an asset--until this past year.

So now I’m on this mission to make my practice run like clockwork so I can grow it beyond six figures, while only doing the parts I love, working part time. Why am I sharing this with you?

Because if you want your business to be a business and work for you, I think you’ll find this valuable.

Also, if you want to venture into advisory services, you have to implement systems first. This will help you get there. So let’s do this:

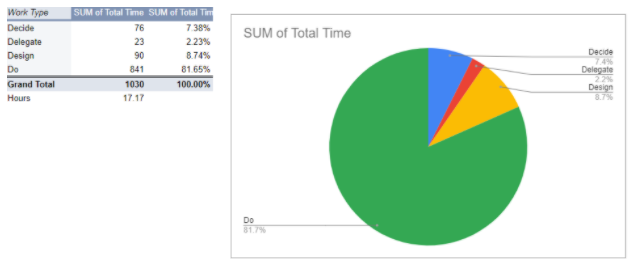

Stage 1 in the Clockwork system is to analyze your time to see what your mix is among the 4D phases:

- Doing - this is self explanatory. This is the work that needs to be done to deliver to the promise to your clients. For us, that’s the bookkeeping, accounting, and advising work.

- Deciding - this is when you assign tasks to others but you are still responsible for the outcome. I see this as more of a manager role. The Doer is not quite empowered to make decisions, so they come back with questions a lot.

- Delegating - this is when you empower the doer to make decisions (and mistakes) because they are now responsible for the outcome.

- Designing - and of course designing is forming the vision, strategy, and running the business by the numbers, while only doing the things that you love.

The optimal mix for a company is 80% Doing, and the rest a mix in the 20%. If you are a solo-prenuer, obviously that’s a lot of doing.

I was terrified about what my time analysis would look like before I finished adding things up, because I felt like I was doing a lot. Given that I have two part time bookkeepers, the percentage of my time doing should be less than 80% if the company as a whole should be at that 80% doing mark.

But before I get to the results of my time analysis, I figure I should share with you my goals.

- In December of 2021 I plan to take off the entire month. This works out to be exactly 18 months from now, which is what the book recommends, and coincidentally, that month will be my birthday, holidays--obviously--and my oldest daughter’s 16th birthday. Since she was little, I’ve always told myself we’d do something BIG for that birthday. So I’m still dreaming it up, but I think travel to somewhere awesome will be in order.

- Like I mentioned before, working less than 20 hours per week in/on my accounting practice. As many of you know, I also mentor and teach other bookkeepers and accountants, so it’s crucial for me to have the time to do that as well as for my 3 kids, dog, and partner, plus my hobbies.

- Goals wouldn’t be complete without a financial metric, because you can’t grow what you don’t track. One thing about financial goals is, well, the fear of judgement. And fear of not hitting the goals. And while I have major determination and won’t let myself off the hook for doing everything I can to reach the goal, if I don’t hit my goal, I won’t make it mean anything about me. If you have trouble setting goals, I encourage you to take this same perspective. So what is my financial goal? A take home pay of $80,000 (after tax, 5% profit left in the business, and operating expenses at 30% or less of Revenue. This means my annual revenue goal is about $145k or better.

Ok, let’s summarize that for ya.

Goals:

- December 2021: 4-week vacation completely unplugged

- Work less than 20 hours/week

- $145k Revenue or better:

- 50% Take Home Pay

- 5% Profit left in the business

- 15% Tax

- 30% Operating Expenses

So where do I currently stand?

Here's my 4D Mix:

So that’s currently less than 20 hours per week. Phew! Felt like more, but that’s because I’m not including the time spent on my other business. In total right now, I’m working about 30 hours per week. The way I see it--it’s easier to maintain something that have to cut it back, so I’m a step ahead here. And I attribute that mainly to the fact that I had to choice but to work less than 20 hours per week, since I work at home with 3 kids. Also, I love my sleep, so I try not to sacrifice that.

Are you trying to get your biz to run on its own, or just get started?

Check out the next 2 posts for an update to where we’re at as of November 30, 2020!

Want all the best bookkeeping biz tips in your inbox?

Join our mailing list to get weekly podcast content, exclusive resources & tips on building your bookkeeping business, and the latest news and updates from our team.

We hate SPAM. We will never sell your information, for any reason. You can unsubscribe at any time.