Bookkeeping for Different Business Structures

Aug 08, 2020

In this blog we’re going to go over the main differences in bookkeeping/accounting for the various business structures. Really, it requires a foundational knowledge of the accounting entries when starting a business. Each structure is accounted for a little differently. Once you understand the foundations, you’ll know how to handle the bookkeeping for transactions that might come up later on.

Sole proprietor or single member LLC

BUSINESS STARTS:

When the business starts out, sometimes the person starting the business contributes capital (cash, inventory or equipment). Sometimes they start out with nothing and bootstrap. If they contribute capital, the entry is:

Dr Asset (cash, equipment, or inventory)

Cr. Owners contribution

The most common way these businesses start is taking a small amount of cash to open a business bank account. That entry would be:

Dr. Bank Account

Cr. Owner’s contribution.

When you set up a new bank account in QBO (Quickbooks Online), it asks you for the beginning balance. Then it books that beginning balance to Opening Balance Equity… Nope… let’s re-class that to Owners contributions. Alternatively, if the account is truly new, you shouldn’t add an opening balance at all (leave blank as in image below). That way you can create the entry yourself with the first deposit.

So now you know what entry should be made when the owner puts money or contributes any type of capital to the business.

WHEN THE OWNER PAYS FOR BUSINESS EXPENSES WITH PERSONAL FUNDS:

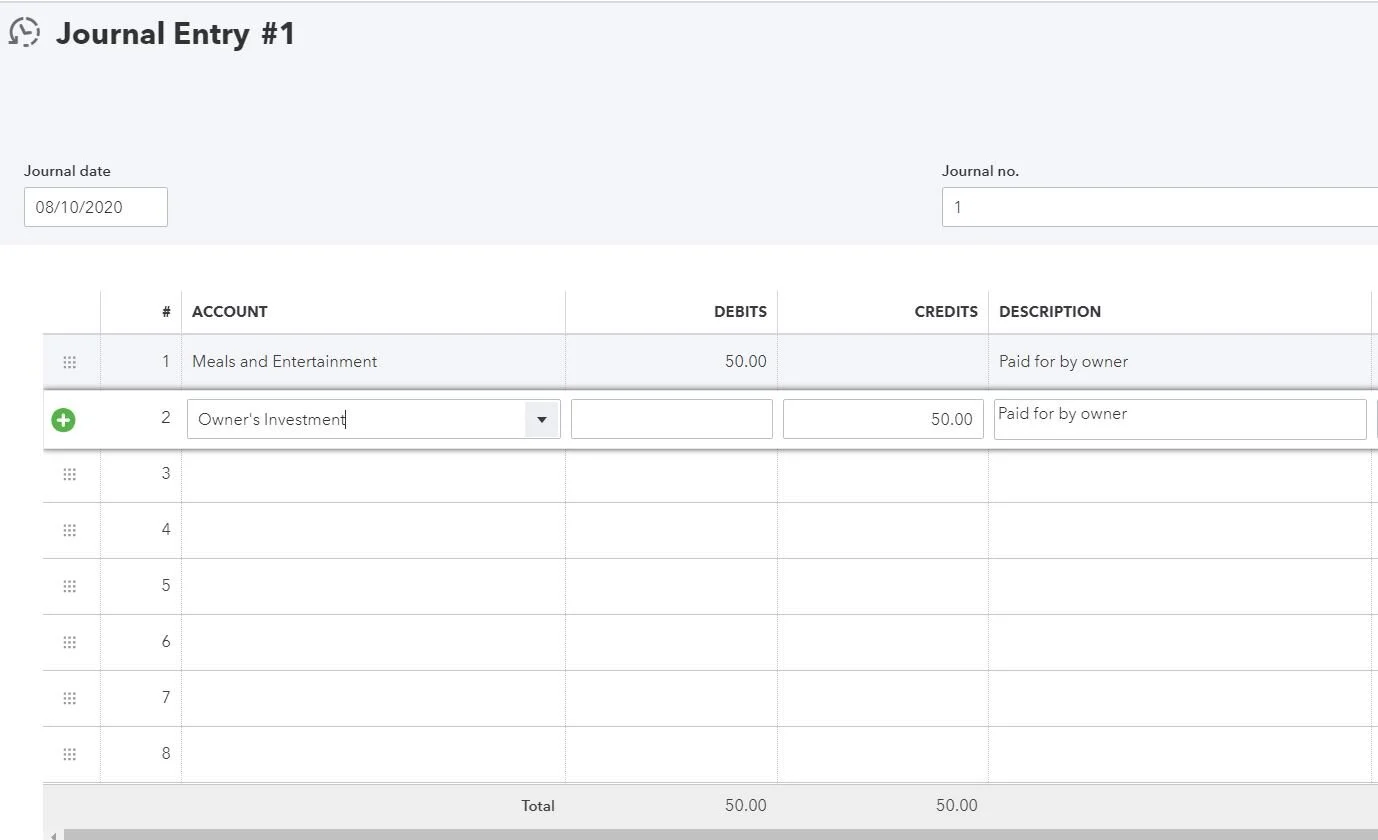

Often when an owner is bootstrapping a business, or started it as a side-hustle, they are using personal funds for business expenses. And this might continue on later. You won’t know if this happens unless the owner gives you a receipt or tells you, since it won’t be in bank feeds.In this case in QBO you would have to create a manual journal entry:

Dr. Expense

Cr. Owner’s Investment

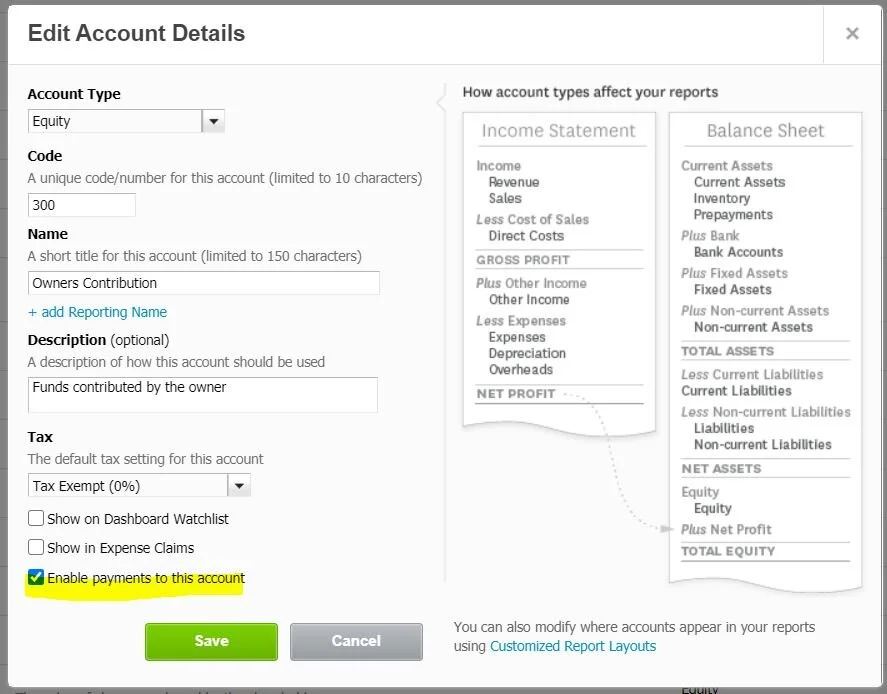

In Xero you would create an Expense Report transaction coding it to the appropriate expense category and “paying it” out from Owners Contribution. You may have to allow payments from this account in setup (See image on how to do this).

The simplest thing to do in both softwares would be to create a journal entry, though.

WHEN THE OWNER USES BUSINESS FUNDS FOR PERSONAL EXPENSES:

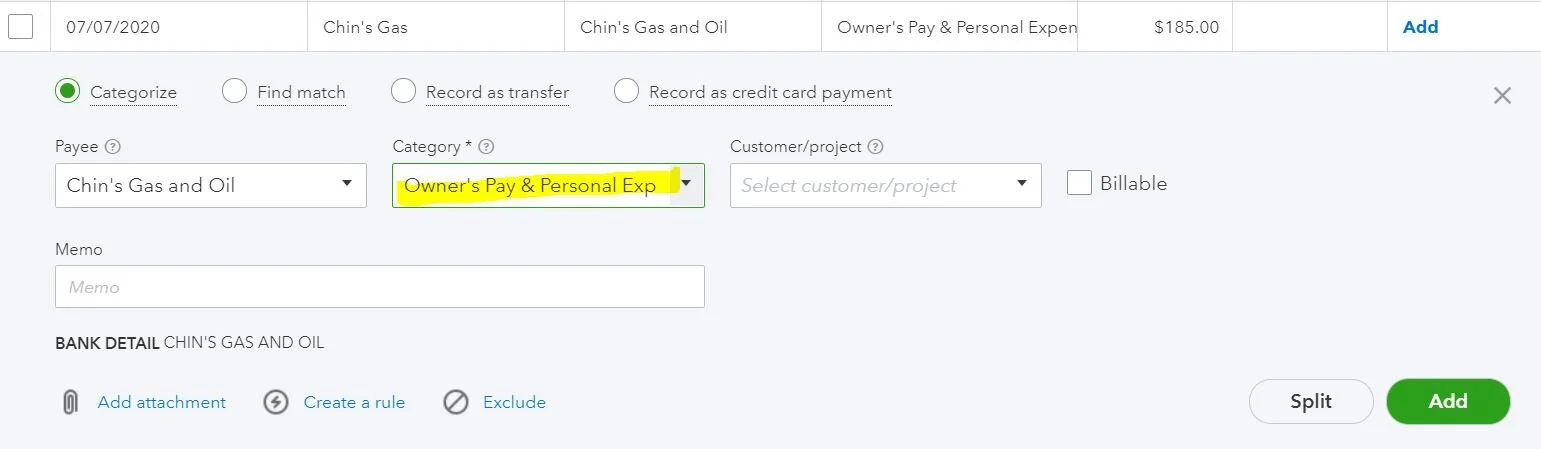

Another common scenario is that the owner pays for personal expenses with the business bank account. (Counsel your client on why they should avoid this—it pierces the corporate veil and could undo the whole reason they created the LLC if they do it enough).

When this happens, instead of categorizing the transaction as an expense, you’ll categorize it as “Owner’s Draws” or as the default in QBO: “Owner’s Pay and Personal Expenses.”

Side note: I do like to have three separate equity accounts:

-

Draws (Owner’s Pay & Personal Expenses)

-

Investment/Contributions

-

PLUS another for Income Tax payments, so you can see the difference between what was paid out and what was contributed.

WHEN THE OWNER PAYS HIM/HERSELF

Treat this the same as personal expenses, putting it straight to owners draws.

Partnerships & Multi-member LLCs

Ok, let’s now get into partnerships. This is very similar to the LLC, because it is also a flow through entity, meaning the entity itself is not taxed (in most cases).

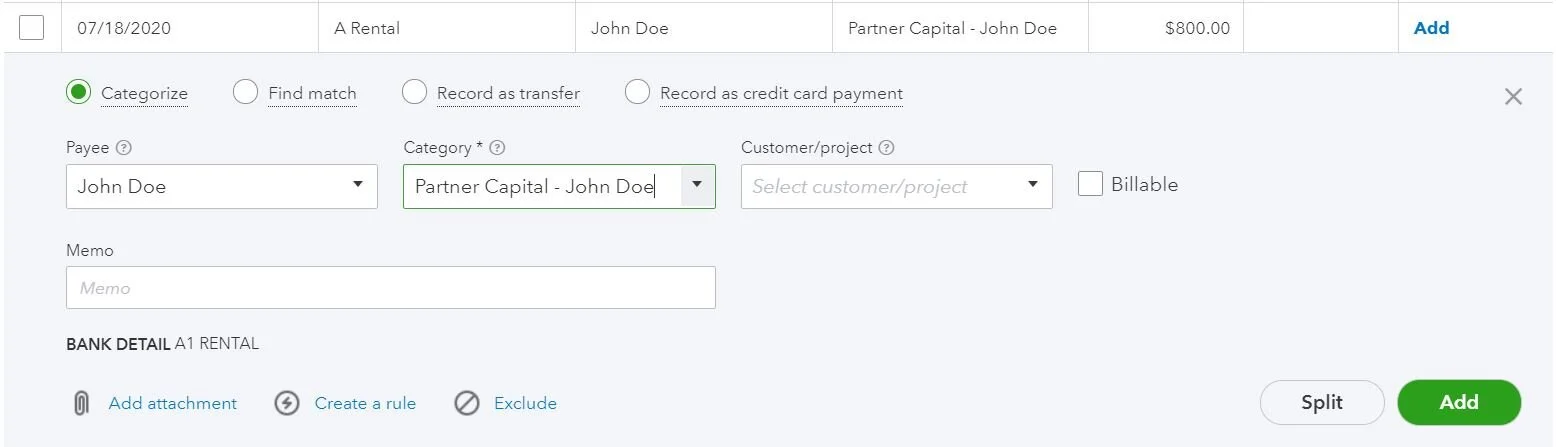

WHEN THE BUSINESS STARTS

The entries for starting a business and opening bank accounts are almost identical to the SP/LLC, except you should have separate equity accounts for each partner, which we sometimes call “Partner Capital” accounts. If there are a lot of partners, two equity (aka capital) accounts for each partner might be a bit much, especially in a larger partnership, since there shouldn’t be much activity besides draws happening.

Dr. Asset

Cr. Partner Capital Account—John Doe

WHEN THE PARTNER PAYS FOR BUSINESS EXPENSES WITH PERSONAL FUNDS:

This is the same as LLC or corporations. Ideally, they should be submitting expenses for reimbursement.

WHEN THE PARTNER USES BUSINESS FUNDS FOR PERSONAL EXPENSES:

Once again, the process is the same as what you would do for an LLC.

WHEN THE PARTNER PAYS HIM/HERSELF:

If the payments are considered guaranteed, with disregard to profits in the business, I’d recommend creating a separate account called “Guaranteed Partner Payments” so it stands out for the tax accountant. Guaranteed payments are basically a salary you give a partner for the work they do in the partnership, even if the partnership doesn’t make a profit. You can learn more about guaranteed payments here.

If the payments are truly draws, they’ll reduce the capital account for the partner taking the draws.

Corporations (S & C)

WHEN THE COMPANY STARTS

When it comes to corporations, it’s very important to have those formation documents when you take on a client to make sure the initial opening of the business was entered correctly on the books.

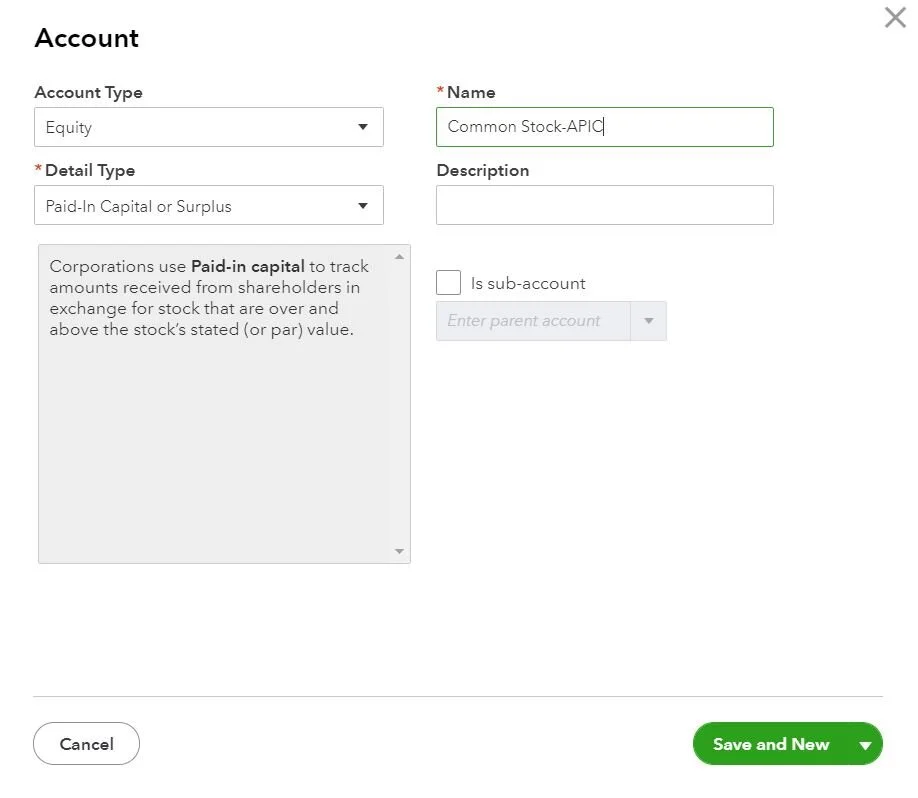

You’ll have at least 2-4 equity accounts, depending on how many classes of stock were authorized:

-

Common stock-Par Value

-

Common stock-APIC (Additional Paid-in Capital)

-

Preferred Shares-Par value

-

Preferred shares-APIC

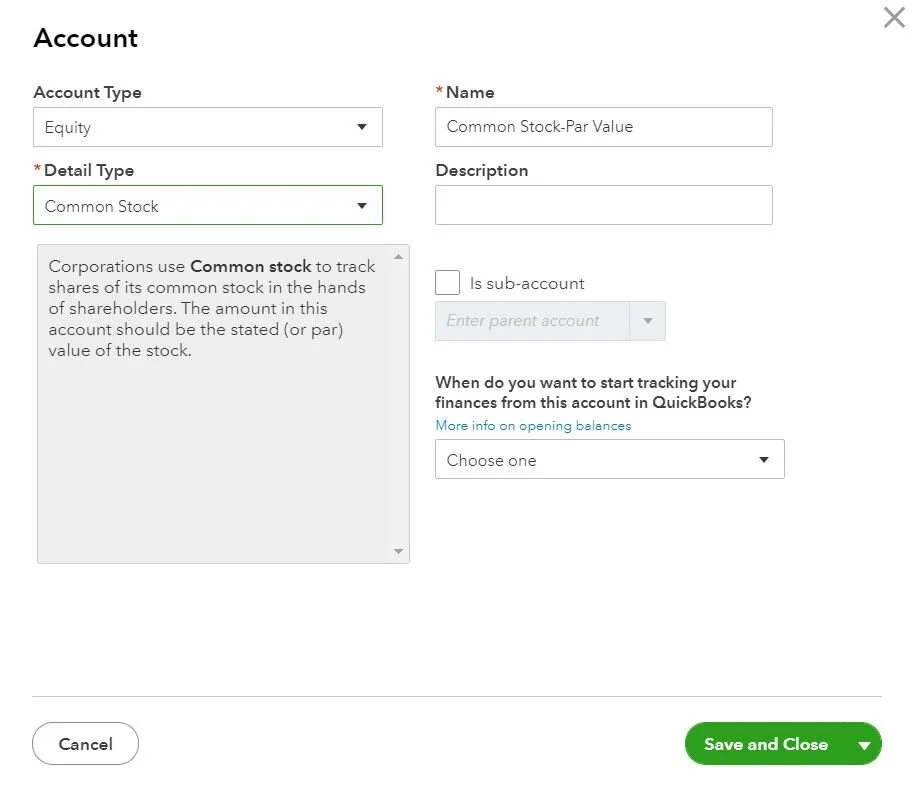

Setup of Common Stock in QBO Chart of accounts

If there was cash or other capital contributed, there should always be some sort of stock issued to the shareholders, even if it’s just one person (shareholder).

Dr. Cash

Cr. Common stock -par value

Cr. Common Stock - APIC

COMMON STOCK & APIC CALCULATION:

The formation documents should say how many shares were purchased and at what exercise price. APIC is the difference between exercise price and par value. Par value should be listed on the corporate formation documents, and is typically .01 or less (in my experience).

You would make these same entries anytime someone exercises shares or is granted shares, and the record should be kept in detail (outside of your accounting system, at least in an excel sheet).

EXAMPLE:

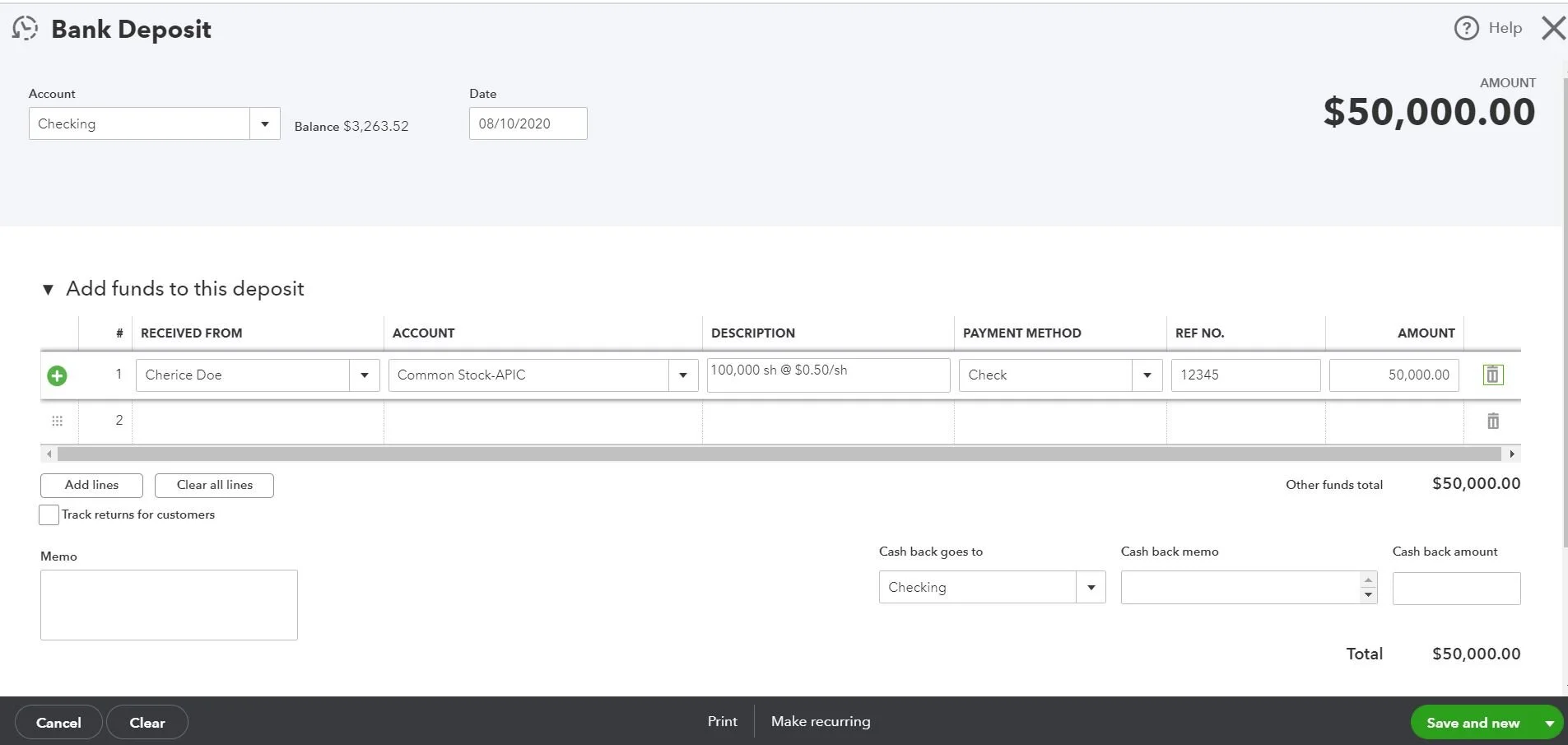

Cherice starts a company and invests $50,000 of her own cash, forming an S-Corporation. She authorizes 1,000,000 shares, but the $50,000 only purchases 100,000 shares, which would mean the price per share was $0.50. If Par value is listed on the documents as $0.01, then you would allocate the entry as such:

Dr. Cash (100,000sh @ $0.50/sh) $50,000

Cr. Common Stock - Par Value (100,000 sh@ .01/sh) $1,000

Cr. Common Stock - APIC (100,000 sh@ 0.49/sh) $49,000

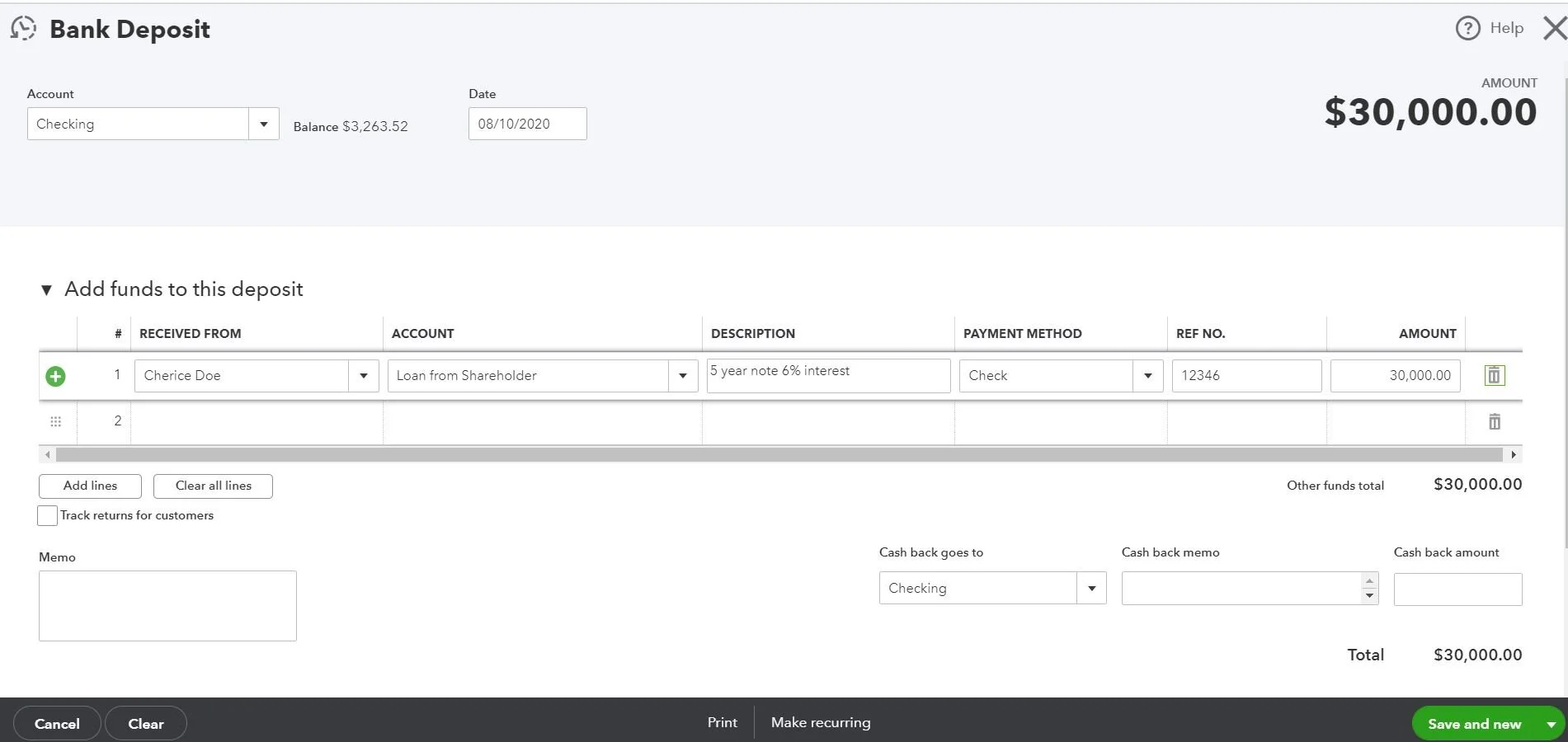

THIS IS HOW THE DEPOSIT WOULD LOOK IN QBO:

WHEN AN OWNER PUTS MORE MONEY INTO THE BUSINESS

One of two things are possible, and it requires a conversation with the client to find out their intentions:

-

Are they loaning the company money?

Or

-

Are they exercising shares?

If it’s a loan:

-

They need to have a written note (agreement within arms length and a reasonable interest rate)

-

You need to have an amortization schedule to record the interest even if it isn’t being paid!

-

The interest is income on a personal level to the person lending the company money

-

At year end, issue a 1099-INT to the shareholder for all interest paid (not accrued—only if it’s actually paid out).

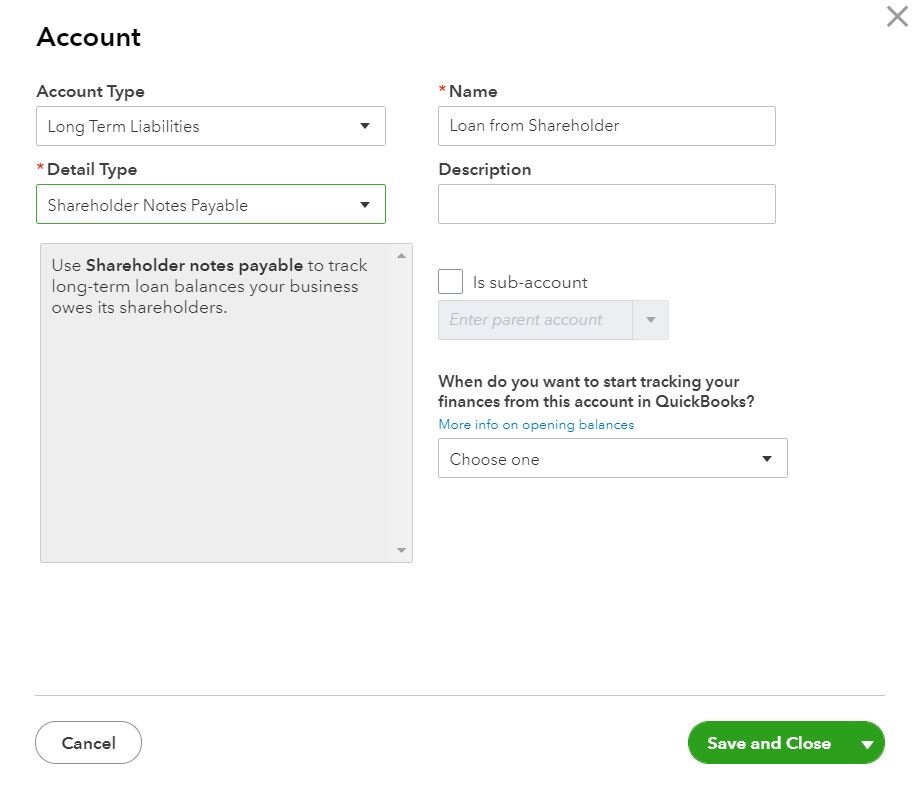

RECORD THE LOAN ON COMPANY BOOKS AS:

-

Dr. Cash (Deposit)

-

Cr. Loan from shareholder (liability account)

-

If it’s an exercise of shares, refer to the entries above just as when the business opened.

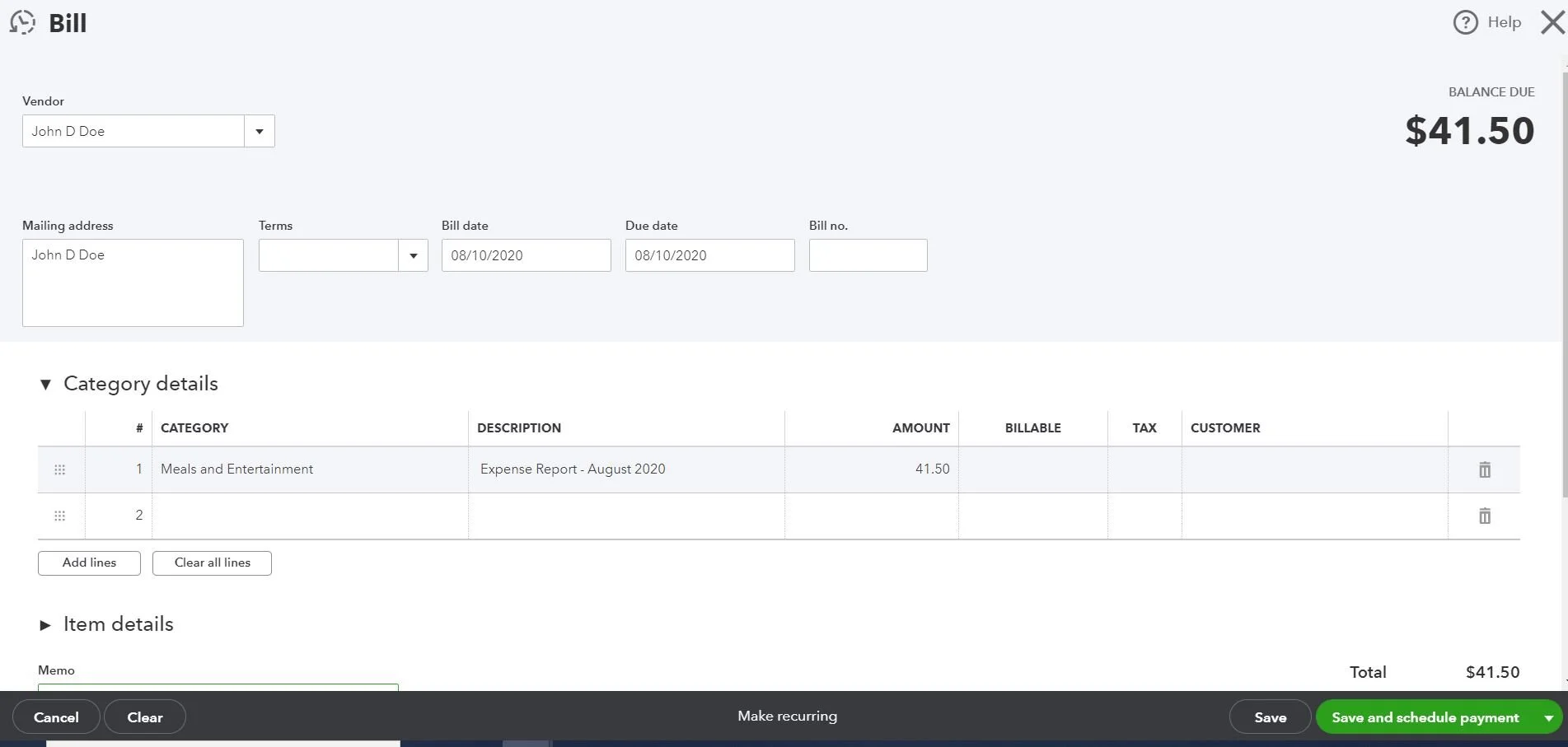

WHEN THE OWNER/SHAREHOLDER PAYS FOR BUSINESS EXPENSES WITH PERSONAL FUNDS:

The shareholder should be submitting expense reports and getting reimbursed on payroll.

Better yet, get them a corporate credit card like Divvy or something with a good points system.

If there are a lot of older transactions that were never reimbursed, you could set up a “Due to shareholder” liability account and set up a repayment schedule with reasonable interest.

Dr. Expense

Cr. Due to Shareholder

WHEN THE OWNER/SHAREHOLDER USES BUSINESS FUNDS FOR PERSONAL EXPENSES:

No. Do not allow.

Ha! But seriously, this will pierce the corporate veil, so just don’t intermingle funds.

Have a serious sit down with this shareholder and help them understand. If they need to adjust their salary, need help with personal finances, just get to the bottom of why this is happening and help them do better.

If there are a lot of small transactions, I’d set up a “Due from Shareholder” asset account and create a repayment schedule for them with a reasonable interest rate. Same as if it were a one time large sum of money they are borrowing from the business.

Dr. Due From Shareholder

Cr. Cash

Make it arms-length.

WHEN THE OWNER TAKES MONEY OUT OF THE BUSINESS:

If they are paying themselves a paycheck, it MUST be through payroll. Corporations are separate entities from them individually, and the reasonable compensation topic is a big one (which we won’t get into here).

If they are taking earnings (distributions) from the business, these are dividends and must be made proportionately to all shareholders. One shareholder can’t decide to take a distribution and not give a distribution to the rest of the shareholders (and likely needs a shareholder vote, depending on the corporate charter—so another reason to get all those formation documents)

Again, there are rules to be followed here, but the entry would be:

Dr. Dividends paid (equity account)

Cr. Cash

They’ll also be issued a 1009-DIV at year end, so if you’re preparing other 1099s, add this one to your list. Learn more about those here.

Want all the best bookkeeping biz tips in your inbox?

Join our mailing list to get weekly podcast content, exclusive resources & tips on building your bookkeeping business, and the latest news and updates from our team.

We hate SPAM. We will never sell your information, for any reason. You can unsubscribe at any time.